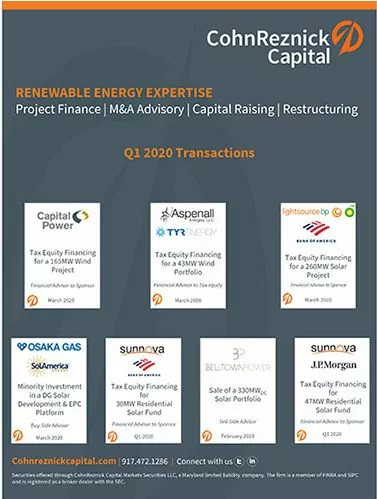

Investment Banking Services Committed to the Sustainability Sector

We provide industry-leading financial services across the full renewable energy spectrum.

Find Out More

Building long-term partnerships by facilitating investment outcomes that directly impact our planet.

Learn MoreOur Impact

#1

Renewable Energy

Financial Advisor

#1 in North America by Deal Count from 2019–2024, Inframation League Tables.

415

Deals Executed

$91bn

Total Transaction

Value

75%

Deals with Repeat

Clients

134

Total GWs

179mm

Tons CO2 Offset

Recent Transactions

CRC-IB Leadership

B.S., Hartwick College

Professional CertificationCPA

Nick Knapp

Partner & Senior Managing Director

Nick is a Partner and Senior Managing Director at CRC-IB. He has 20 years of experience in M&A and structured finance advisory with leading sustainable energy companies and investors. Nick has raised over $7B in equity, debt, and tax capital, with projects ranging from 5MW to 500MW.He has a core focus in wind, solar, carbon capture, and battery storage projects and platforms, with transaction experience spanning residential, distributed generation, and utility-scale.

Nick’s recent experience includes raising tax capital for some of America’s first and largest carbon capture and storage projects, providing strategic guidance, and leveraging his sector expertise to support and educate new market participants. He has also advised top clean energy sponsors and global utilities on both sell-side and buy-side M&A transactions, helping them evaluate and execute corporate and asset deals. Additionally, Nick has guided Fortune 100 corporations in deploying capital for renewable energy projects, aligning ESG objectives with effective management of tax liabilities and investment strategies.

Prior to joining CRC-IB, Nick was a Transaction Advisor in the Structured Finance Group at GE Energy Financial Services, focusing primarily on renewable energy investments in the U.S., Europe, Canada, and Japan.Before that, he worked in the Transaction Services Advisory practice at KPMG’s New York office, providing accounting, tax, and financial modeling services to renewable energy clients.

Nick has a Bachelor of Science in Accounting and Finance from Hartwick College and is a member of the American Institute of Certified Public Accountants.

B.A., Providence College

MBA, Columbia Business School

CFA

Conor McKenna

Partner & Senior Managing Director

Conor McKenna is a Partner and Senior Managing Director at CRC-IB. He has advised on over 200 sustainable energy transactions across utility scale, distributed generation, and residential assets during his decade plus career. Conor provides strategic and transaction advisory services including platform and project M&A, corporate capital raising, and structuring, negotiating and financing tax equity and debt investments. Conor’s renewable energy expertise has been honed working with the leading strategic, infrastructure and financial institutions. He has a strong relationship network and is adept at creating unique financing structures for energy companies, developers, power producers, and private equity/infrastructure funds.

Conor was the firm’s first dedicated renewable energy banker. Prior to joining CRC-IB, Conor worked in the Renewable Energy Structured Finance Group at Evolution Markets, focusing primarily on Renewable Energy Credits and Bundled PPA’s. He was previously a member of EcoSecurities’ investment team, where he helped manage large carbon project portfolios.

Conor received his MBA from Columbia Business School and his BA from Providence College. He is also a CFA charterholder.

B.A., Colgate University

MBA, Cornell University

Britta von Oesen

Partner & Senior Managing Director

Britta is a Partner and Senior Managing Director with CRC-IB. She has 15+ years of experience in investment banking, mergers and acquisitions, corporate strategy, and project finance and development in the wind, solar, storage, and broader sustainability sectors.

Britta primarily focuses on transaction management, including corporate M&A, project finance, and tax equity structuring and negotiation with over $15B raised for sustainable energy to date. She has led numerous renewable energy financings, mergers, and acquisitions for utility-scale and distributed generation wind, solar, and storage companies and assets, both in the U.S. and globally.

Before joining CRC-IB, Britta was Head of Corporate Strategy and Development for Gestamp Solar, where she led M&A transactions and project financings for U.S. solar projects. Prior to Gestamp Solar, Britta was a Group Manager for Windkraft Nord AG, a German wind and solar developer, managing the Italian operations for the development of a 1GW+ portfolio of wind and solar assets throughout Italy. Before moving to Italy, Britta worked with Lehman Brothers’ Global Power Group.

As one of few senior women in renewable energy finance, Britta has received multiple industry awards, including the 2020 U.S. C3E Finance Award issued by the U.S. Department of Energy; 2020 ‘Most Influential Women in Business’ by the San Francisco Business Times; and Renewable Energy World’s ‘Solar 40 Under 40’ in 2018.

Britta received an MBA with honors in Finance from Cornell University’s Johnson Business School in 2009 and a B.A. in Environmental Biology from Colgate University in 2003.

Britta serves as Co-Chair of the Solar Energy Industries Association’s (SEIA) Women’s Empowerment Sub-Committee.

B.S., University of Florida

MBA, Villanova University

CFA

Gary Durden

Partner & Managing Director

Gary is a Partner and Managing Director with CRC-IB. He provides transaction management and advisory services for clients in the sustainable energy sector, including corporate M&A, capital raises, and structured finance solutions for wind and solar projects. Gary has closed equity investments in over 12GW of utility-scale and C&I wind and solar projects, including tax equity, cash equity, and sale lease-back transactions.

Gary was previously a Senior Vice President at GE Energy Financial Services, where he led deal teams in the structuring, diligence, and negotiation of investments in renewable energy projects in the US and Canada. Prior to GE EFS, Gary worked at Standard & Poor’s, developing models used by commercial banks for assessing the credit risk of C&I companies.

Earlier in his career, Gary served as an officer in the United States Navy, supervising the operation of nuclear reactor plants on aircraft carriers and teaching college-level classes to university students enrolled in the Naval Reserve Officer Training Corps.

Gary is a CFA charter holder and earned an MBA from Villanova University and a B.S. in Mechanical Engineering with Highest Honors from the University of Florida.

M.C.E./M.S., European Engineering School of Chemistry, Polymers, and Materials Science

Masters in Strategy and Management of International Business from ESSEC Business School

Nicolas Chery

Managing Director

Nico is a Managing Director with CRC-IB with over 10 years of experience in advisory and transaction management across utility scale, distributed generation, and residential energy assets. Specializing in tax credit, project finance, and structured finance for the sustainable energy sector, Nico has successfully raised over $7 billion to date.

Prior to CRC-IB, Nico served as Executive Director in J.P. Morgan’s Energy Investments division, where he structured tax equity investments in 17 wind projects, 26 solar projects, and over 37,000 residential solar systems totaling 3,334 MW of capacity. He also led J.P. Morgan’s first investment in utility-scale energy storage. Nico began his career in syndicated and leveraged finance at Credit Agricole CIB.

Nico is a CFA charter holder and holds Master’s in Chemical Engineering and Materials Science from the European Engineering School of Chemistry, Polymers, and Materials Science in Strasbourg, France, as well as a Master’s in Strategy and Management of International Business from ESSEC Business School in Paris, France.

B.A., University of Texas at Austin

Andy Nguyen

Managing Director

Andy is a Managing Director with CRC-IB. He provides transaction management and advisory services for clients in the Sustainable Energy sector including corporate and asset M&A, as well as tax equity and debt financing solutions to renewable energy projects with over $1B in project financing and $1.6B in enterprise value for corporate financing raised to date.

Andy was previously an Associate at Vert Investment Group where he was a key team member of a renewable energy merchant bank advising and investing in renewable energy projects with a focus on solar and wind.

Andy received a Bachelor of Arts in Government from the University of Texas at Austin.

B.A., Brandeis University

Professional CertificationCFA

Michael Tatarsky

Managing Director

Michael is a Managing Director with CRC-IB. He provides advisory and transaction management services, including corporate and asset M&A, capital raising, tax equity, and debt, for wind, solar, battery storage, and fuel cell platforms and projects. Michael has executed over $5 billion of equity, debt, and preferred equity transactions across 15GW+ of renewable energy projects.

Michael has dedicated his entire 10-year career to renewables. He joined CRC-IB as a Senior Associate in 2015. Before joining the firm, Michael was an Associate with Banco Santander’s Asset & Capital Structuring team, where he originated, structured, and executed renewable energy investments for clients. Michael started his career at Deutsche Bank as a Project Finance Analyst focused on energy and infrastructure.

Michael graduated from Brandeis University with a double major in Economics and Business and is a CFA charterholder.

B.S, Massachusetts Institute of Technology

Professional CertificationCFA

Michael Yurkerwich

Managing Director

Michael is a Managing Director with CRC-IB. Since joining the firm in 2013, Michael has advised on over $1 billion in buy and sell-side transactions and $500 million in structured equity financing, totaling more than 3GW of renewable energy assets.

Michael provides advisory services including process management, due diligence, structuring and deal negotiation in the renewable energy sector. He specializes in structuring acquisitions, strategic partnerships and tax equity investments across utility scale and distributed generation assets. In 2014, Michael led structuring activities related to the acquisition of 125MW of solar assets and the tax equity financing of a 300MW wind project. He has provided financial advisory services to numerous clients ranging from private equity firms and investment banks to IPPs and renewable energy developers.

Prior to CRC-IB, Michael worked for a boutique private equity firm analyzing energy investment opportunities in the oil and gas sector, while managing and enhancing the efficiency of existing portfolio investments. Michael also worked for a venture capital funded battery technology company with applications in the medical device industry.

Michael is a CFA charter holder and received a Bachelor of Science in Management Science with a concentration in Finance and a Bachelor of Science in Material Science and Engineering from the Massachusetts Institute of Technology.