2022 Renewable Energy Summit – Key Takeaways

After a two-year hiatus due to the coronavirus pandemic, many of the top renewable energy industry leaders convened at CohnReznick and CohnReznick Capital’s 9th Renewable Energy Summit in June to discuss pressing issues and emerging trends shaping the industry. Read on for some of the key takeaways from the Summit.

State of renewable energy policy

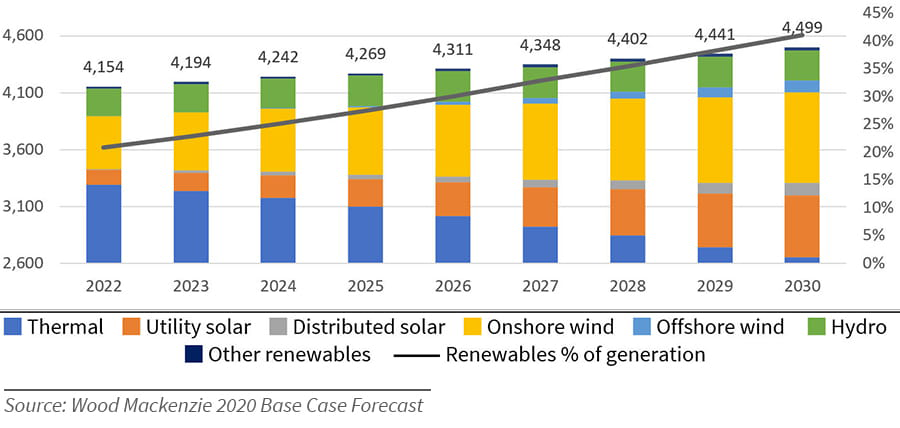

Those at the event generally agreed that after years of record installations of renewables, U.S. climate policy is imperiled with priorities shifting away from the clean energy transition toward trade conflicts and supply chain disruptions. Yet, despite these and other macroeconomic risks, the renewable energy industry continues to grow. The prioritization of ESG (environmental, social, and governance) goals, collaboration and innovation between companies, and adaptation to risk has allowed the sector to continue expanding. However, policy initiatives remain critical to renewables becoming 40% or more of U.S. energy generation by 2030.

Deal flow and the future of the industry

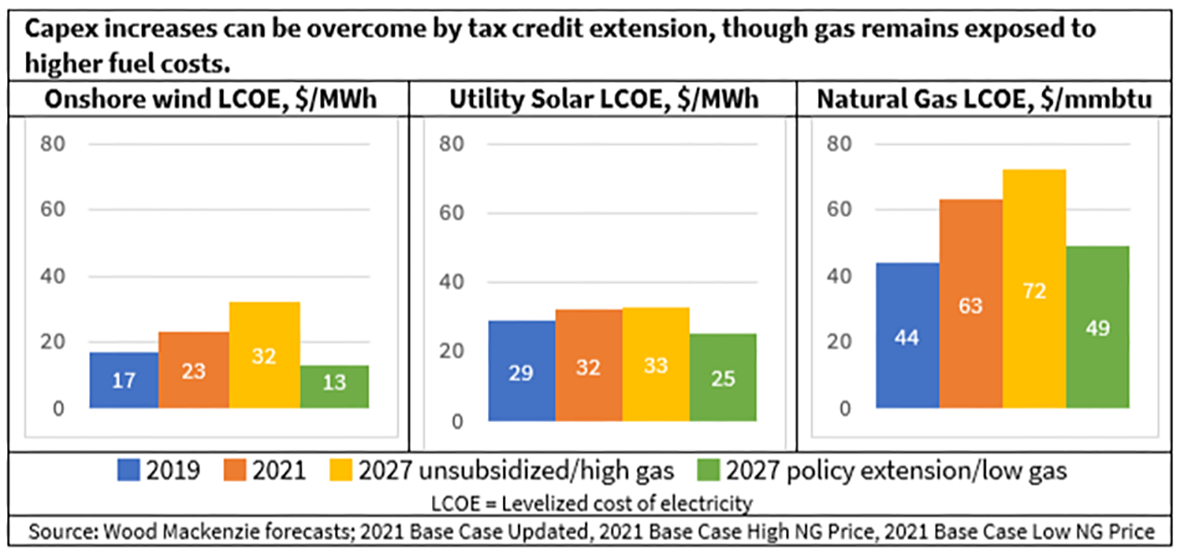

With inflation, COVID-19, and supply chain constraints, the industry expected a slowdown in 2020 and 2021. However, deal flow continued to ramp up. Although renewables face headwinds, fossil fuel generation also is exposed to risks from climate change, rising fuel costs, and supply chain disruptions. This risk exposure has led to the continued shift of capital away from traditional fossil fuels and into renewables. Significant drivers behind deal origination also include rising corporate commitment to decarbonization and the strong belief in the growth trajectory of the renewable energy industry. These factors often arise from the tremendous pressure to meet ESG goals, which comes not only from shareholders but also from rating agencies that increasingly focus on climate risk in their calculus. What’s clear is that companies substantively believe in renewables for the long term – a sentiment reflected in improved valuations.

ESG euphoria

The virtues of ESG are many, but several complexities exist, especially for new entrants. For companies looking to achieve ESG goals, technology and funding are two of the most challenging issues. Determining the right time in a company’s life to adopt emerging technologies like carbon capture utilization and sequestration (CCUS) or battery storage is difficult. Companies new to ESG investing have echoed the need for strong guidance from experienced players to help create awareness and understanding among internal stakeholders and navigate challenges in an evolving market.

Risks and flexibility

Renewable energy deals have become more complex due to the evolution of risk. For the first time in the industry’s recent history, we sit in an inflationary environment with rising rates, creating another set of variables for sponsors to assess and plan around. While it remains to be seen what this will mean for the cost of capital on projects and potential adjustments to the commercial revenue and offtake story, material adjustments are coming, and the industry must prepare to adapt to a new set of risk variables.

Assets and underwriting valuation are much more complicated. Climate change impacts projects, thus materially affecting insurance markets and overall costs. Solar + storage solutions are becoming market standard as corporations seek distributed generation and grid resilience to meet dynamic energy needs. Additionally, innovation in offtake structures and risk transfer instruments has evolved to address commercial and risk considerations. Stakeholders and energy experts have emphasized the importance of transparency and clear communication, particularly around supply chain risks. An ongoing problem is that risks are being addressed too late. Early identification and awareness of potential issues is paramount for avoiding and recovering from build-ups, delays, and other problems.

Upward trajectory

Since the event, the announcement of the Inflation Reduction Act, an offshoot of the Build Back Better legislative effort, has created new enthusiasm should such legislation become law. If passed, this new combination of energy and tax policy would represent a golden age of clean energy adoption and finance.

The complexities and nuances of the industry continue to evolve, but the outlook for renewables is bright. Hurdles remain, but the sector continues to adapt to mitigate impacts. Industry participants at the Summit expressed cautious optimism that policy and trade issues would resolve and that there would be tax credit extensions. The overall sentiment was one of great excitement and determination to continue the acceleration of the clean energy transition.