Quarterly Considerations Q2 2024

M&A Trends

M&A market sentiment has improved through H1 2024.

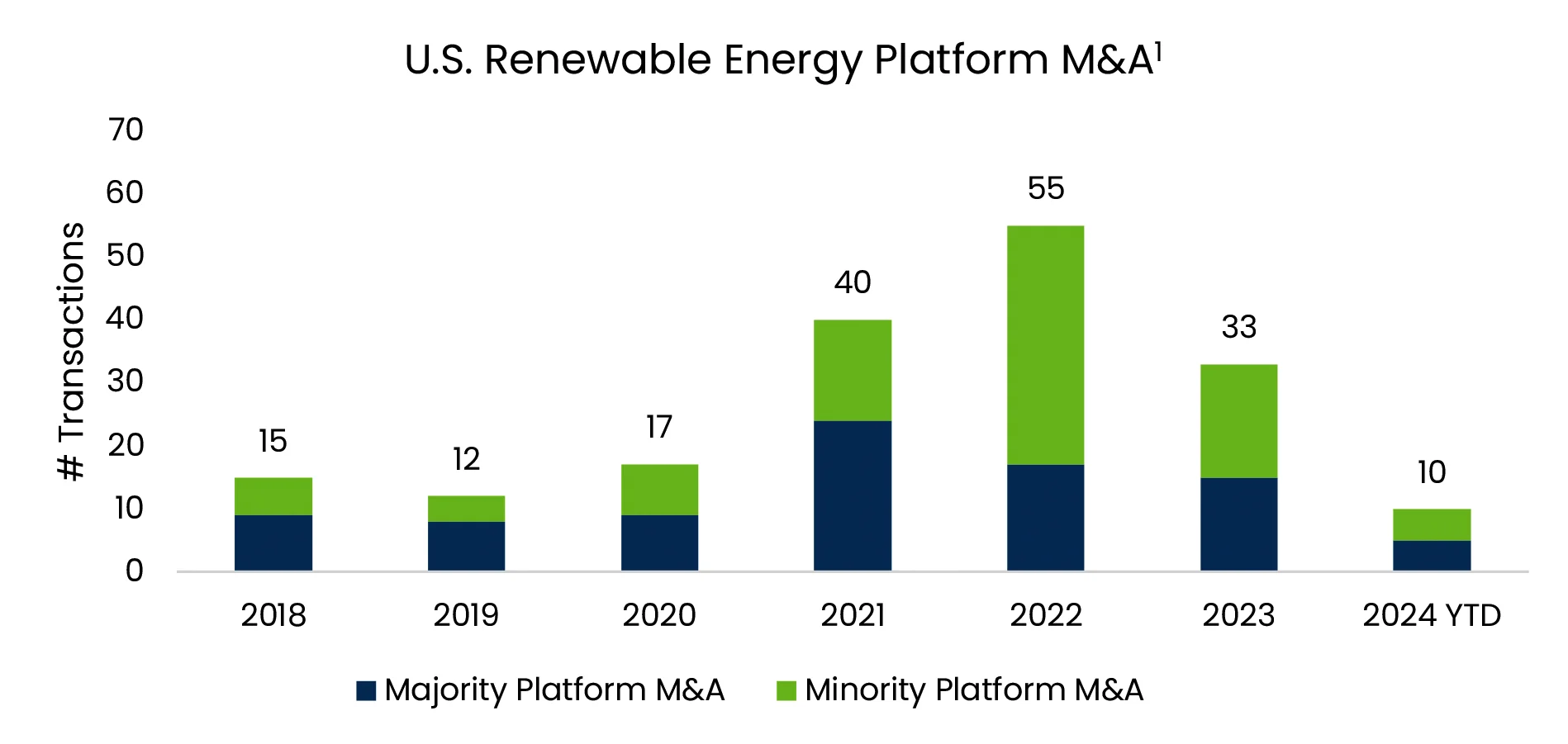

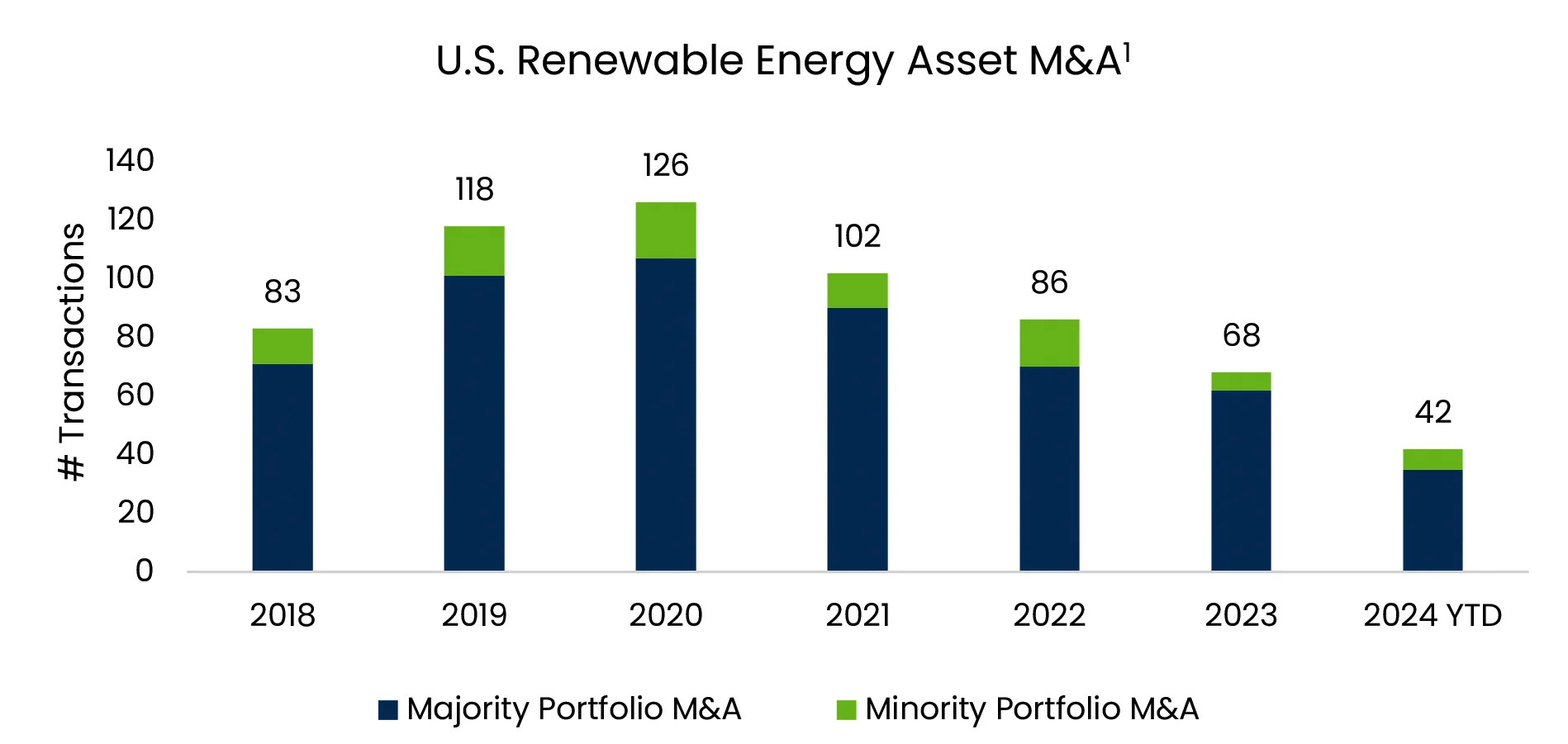

Despite recent softness in the M&A market, we are witnessing a positive shift in investor and sponsor sentiment, with signs of increased market activity through the first half of 2024. Through Q2 2024, there have been 42 completed renewable energy asset M&A transactions and 10 platform sales.1 There are still lingering uncertainties related to inflation, anticipated interest rate cuts, and the upcoming U.S. election. As a result, CRC-IB anticipates some platforms will opt to enter the market later in ’24 or early ’25.

Strong demand for growth capital exceeds currently available supply, resulting in a competitive financing market. Platforms that have not yet been acquired or are self-financed are increasingly seeking capital to grow their pipeline and operations to compete with well-capitalized competitors that were acquired or have already raised capital. In this environment, platform differentiation and having an advanced, high-quality pipeline will be critical to a successful transaction.

Industry consolidation and competition have further spurred M&A activity as platforms seek scale. Platforms that have transitioned to an IPP business model are increasingly looking to augment scale and optimally position themselves for a potential liquidity event in the future. As a result, some developers / IPPs that previously completed transactions now look to acquire platforms that can be integrated into their operations. These platforms seek exposure to new markets to find cost efficiencies through scale and synergies that can accelerate growth. As renewable asset demand grows and platforms increasingly focus on scaling operations and acquiring projects, platforms with greenfield origination capabilities will garner strong interest in the market.

After more than a decade of relatively flat electricity demand, we are now experiencing significant load growth driven by data centers (including those focused on AI and bitcoin mining), manufacturing, and the rising interest in electric vehicles. This surge in electricity demand is forecasted to continue, and with investors (especially corporates) increasingly targeting ESG mandates, there is a growing emphasis on clean energy sources to fill the gap between supply and demand. As a result, there is a heightened demand for clean energy, prompting investors to show greater interest in acquiring renewable energy projects and platforms. This strategic interest can position investors to capitalize on the rising demand for energy and optimize their portfolios to attain security of supply.

The “triangulation of valuation”

The market is increasingly using EBITDA multiples to value development platforms. However, this metric can range widely for developers, especially those who lack significant operating assets and recurring revenue. CRC-IB believes that platform valuation using an enterprise value ($) / unweighted identified pipeline (MW) is a more consistent way to evaluate platforms, especially those primarily comprised of pipeline vs operating assets.

A “bottoms-up” discounted cash flow (DCF) analysis – relying on an asset-based build-up to cash flow – is the primary method of valuation. Buyers then use market knowledge and transaction experience to adjust projections based on market assumptions. A comparable company analysis can help support the DCF valuation. However, there are certain limitations; notably, the paucity of relevant public comparable companies. Comparing scale is also challenging – for example, contrasting an IPP with significant operating assets against a smaller “dev + flip” platform. Additionally, precedent transactions can help validate the valuation, when available. Although there have been a significant number of completed platform transactions since 2021, the private nature of these transactions means comps can be limited.

The market is seeing an increase in discount rates.

The assumed range of discount rates for platform acquisitions has increased to 10-25%+. Infrastructure funds are at the lower end of this spectrum, while the higher end is primarily associated with buy-out shops. While discount rates are highly dependent on buyer type and model assumptions, this rise reflects the increasing hurdle rates for all investors, continued cost pressures, and the exposure to tariffs due to reliance on imports in certain industries. These dynamics are driving investors to demand higher returns to compensate for the elevated risks and costs associated with new investments. As discount rates rise, platforms must adapt strategies to navigate and attract potential buyers. Differentiation through scale, low costs, and market and technology diversification is key.

Certain platforms are changing how they operate.

Renewable energy platforms are navigating a challenging middle ground. Many have adopted an independent power producer (IPP) business model but lack a significant operating asset base, necessitating several years of cash outflows to build projects and cover selling, general, and administrative expenses (SG&A) before generating significant revenues. Higher financing rates, rising construction and development costs, and congested interconnection queues underscore this problem. Moreover, investors have a longer, more difficult path to attain investment yield due to the substantial upfront capital required before sufficient recurring revenues materialize.

As a result, developers under the IPP model are reevaluating the portion of assets they hold or sell. Many platforms have elected to sell a greater portion of their assets to cover SG&A and generate near-term cash flow. Attractive development fees in community solar, for example, have also contributed to this trend.

Project Finance Trends

Cost of capital remains stable, with an uptick in sponsor equity hurdles.

- Tax Equity Yield-Based Flips: 8.0-9.0%

- Tax Equity Calendar-Dated Flips: 1.14x-1.25x MOIC

- Transfer Pricing: $0.89-$0.95 (gross)

- Term Debt: SOFR + 175-200bps2

Tax capital and debt pricing remain largely unchanged. Thus, CRC-IB maintains the current cost of capital summary from the Q1 Quarterly Considerations. However, the market is seeing an increase in sponsor equity hurdle rates across all technologies. Over the past 6-12 months, sponsor return requirements have increased approximately 150bps and currently sit around 10% for solar tax equity and 10.5% for wind tax equity transactions. Sponsor returns are trailing behind the increases in tax and debt capital seen in recent quarters. Given their subordinate status in the capital stack, sponsors have a higher tolerance for risk and must be flexible in response to changing market conditions. Thus, their return adjustment, in response to increased costs and interest rates, for example, was delayed.

The current transferability market is robust, with large transaction volume driven by strong demand.

Taxpayers transferring clean energy credits or receiving direct payment must complete the pre-registration process and receive a registration number via the IRS Energy Credits Online (ECO) portal. As of April 2024, the IRS reported over 900 entities have registered their projects, with 59,000+ registration numbers across all 50 states. 97% of these projects were registered to pursue transferability.3 In late April, the Treasury and IRS released the final regulations on the transfer of energy credits under section 6418 of the Internal Revenue Code, which became effective on July 1, 2024. The final guidance largely mirrored the proposed regulations published in June 2023 while reaffirming some key points:

- Bonus credits may not be transferred separately: Sellers can transfer portions of a tax credit and have multiple buyers for portions of a single credit. However, in cases where the seller is also earning IRA bonus credits, the base and bonus credits may not be transferred separately.

- Proceeds for credit purchases must be “paid in cash”: All payments from transferee to transferor must be paid in cash. Despite receiving comments to accommodate advanced payments for future credit transfers, the IRS prohibits prepayment. However, the guidance allows sellers to borrow against expected future proceeds from tax credit sales, whether the lender is the transferee taxpayer or another third party.

- Recapture risk stays with the transferee: Given the ITC vests over a 5-year period, transferees must conduct diligence on both projects and sponsors and ensure they have indemnifications from the seller against recapture events, which must be backstopped by credit-worthy entities or an insurance product. For PTCs, there is no recapture risk, and tax credit buyers manage production risk for the PTC by purchasing the credits in arrears. The universe of tax credit buyers willing to commit to a 10-year PTC purchase is more limited.

- Transferor is first responsible if an excessive credit transfer occurs: If a transferee claims a tax credit amount greater than the allowable credit to the transferor, the excess amount is imposed as a tax and may be subject to a 20% penalty. Any disallowed tax credit first reduces the tax credit retained by the transferor before reducing the tax credit to any transferee.

Hybrid transactions are evolving to meet the diverse needs of the tax capital market.

Hybrid transfer structures have gained significant traction, driven by the differing needs and strategies of tax capital investors and project sponsors. CRC-IB is advising clients on both “tax equity hybrid” and “cash equity hybrid” transactions, maintaining a leading position in the market with numerous touchpoints as the landscape evolves.

Traditional tax equity players, especially the big banks, are showing interest in the tax equity hybrid structure because of their large yet finite tax liabilities. These banks are typically relationship-driven and often need to decline clients they want to accommodate. By having the option to sell a portion of their tax credits, banks can stretch their capacity across more deals and clients, maintaining essential relationships while contributing significant capital. In contrast, smaller, less traditional tax credit investors still prefer traditional tax equity deals and are less interested in hybrid structures. These participants are not as relationship-driven and are more focused on completing one or a few transactions, with less of a need to “do more deals”. The other hype of “hybrid” is a cash equity hybrid transaction. Under this structure, cash-focused investors are developing a preferred equity product to form a partnership with a project owner to effectuate a step-up in basis. While these investors do not disproportionately take accelerated depreciation, their partnership increases the ITC amount. Hybrid structures are opening the market to new investors and increasing capital supply.

Sponsors find hybrid deals appealing not only because they increase tax capital supply but also because (i) the tax equity investor monetizes accelerated depreciation (in the case of a hybrid deal with a traditional tax equity investor) and (ii) the step-up in basis increases the ITC amount resulting in better economics for the sponsor. Due to their complexity and scale, hybrid transactions are more likely to involve larger sponsors. However, there is growing competition to find more sponsors to do deals with, which in turn grants smaller developers the ability to do hybrid transactions. Historically, one of the constraints for smaller developers has been the lack of a strong balance sheet as tax equity investors sought creditworthiness. Over the last 2-3 years, the tax insurance market has grown, providing an effective solution for less creditworthy developers and allowing smaller players to participate in hybrid transactions.

CRC-IB’s Recently Completed Transactions

References