Key Takeaways from CRC-IB and Wood Mackenzie CCUS Webinar

CRC-IB and Wood Mackenzie recently hosted the webinar “Creating a pathway for future growth in the CCUS sector” featuring an esteemed panel: Nick Knapp (CRC-IB, Partner & Senior Managing Director), Bret Estep (Tenaska, Vice President, Development), Jon Probst (Summit Carbon Solutions, Chief Commercial Officer), Ben Condon (Energy Capital Partners, Principal), and Peter Findlay (Wood Mackenzie, Director, CCUS Economics). Here are some key takeaways.

Market Expansion and Challenges.

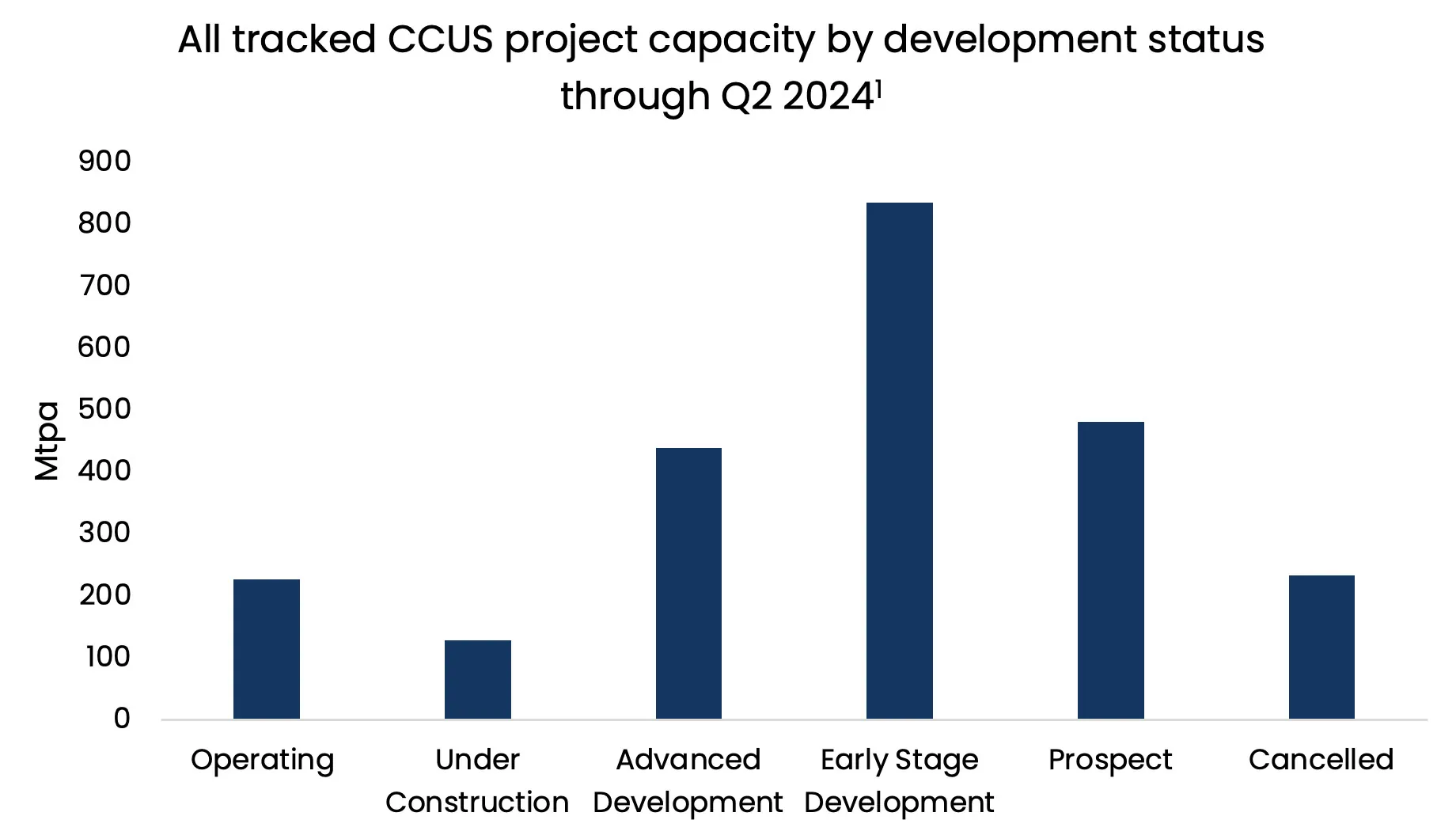

The carbon capture, utilization and storage (CCUS) sector is rapidly expanding with over 1200 projects announced globally. However, most projects, 56% of announced capacity, are in early stages due to financing, technology, regulatory and permitting hurdles. Getting CCUS projects to final investment decision (“FID”) remains challenging. While 70% of global CCUS projects are targeting FID in the 2020s, only 20% have crossed the threshold to date.

The capture-storage gap is a significant trend.

Storage projects still have 46% more planned capacity than capture projects, as developers are building large storage hubs and expecting emitters to capture and provide tolls. A reason for this gap is a function of development: it’s relatively easy to have a large storage hub and not have to build all the wells, whereas for capture projects, you must build everything at the beginning. At the end of the day, many project decisions come down to the emitter. Are they willing to capture? Are the economics attractive enough for the emitter to capture?

The CCUS market can be divided into three approaches:

- Long-linear pipeline for a geographically constrained set of emitters. Although permitting may be more challenging, developers pursuing this strategy can aggregate multiple revenue streams by providing various emitters with access to sequestration.

- Single source, single sink. This has been the primary early-mover business model in this emerging industry. For this approach, there needs to be an existing facility on top of storage and thus, economies of scale can get tough.

- Hub and spoke. This matches sequestration sites with close-by emitters that are feasible to capture. This provides for a diversified set of projects that can target areas with the highest concentration of emitters. Once the wells and transportation are built, it is easy for emitters to tap in.

Tax capital is an important part of the story.

CRC-IB is seeing strong interest from tax investors – banks and corporates, especially – in CCUS. Project developers welcome this interest as tax equity provides certainty through (1) a commitment for the full 12-year profile of the 45Q credits, (2) material upfront capital, and (3) the ability to lever via bank financing on the contributions that are monetizing the tax credits. Tax capital is also a flexible product with the IRA providing the ability to sell tax credits to a purchaser. Guidance has since allowed for good risk mitigation, only requiring 20% of upfront contributions, which minimizes risk for investors and makes the investment more performance based.

There will be incentives to capture CO2 after the 12-year duration of 45Q, the panel believes.

Carbon capture will remain critical to achieving global CO2 reduction and energy transition goals. Companies with economies of scale can position themselves as low-cost leaders in carbon abatement, regardless of future tax credit extensions. Once the infrastructure is built, it enables cost-effective integration of additional emitters, enhancing long-term profitability. Additionally, most new power plants (natural gas plants, for example) are expected to be built with storage. Thus, those plants will have the tax credits as well as the long-term revenue from the plants themselves.

The Voluntary Carbon Market (VCM) is developing as a merchant-like incentive and an ESG win.

There are currently few carbon credits to be traded, but once carbon capture is established as a cornerstone of U.S. infrastructure, more operational capacity will bring an increased volume of carbon credits supply. Proper forecasting and alignment between project developers, investors, and emitters can prove favorable, assuming mechanisms like carbon pricing as future incremental incentives. The panel believes that carbon credits have the potential to trade at a premium to RECs, as they prove to be a more direct way to mitigate carbon.

References