CohnReznick Capital Advises sPower in Raising Tax Equity for 155MW Solar Portfolio

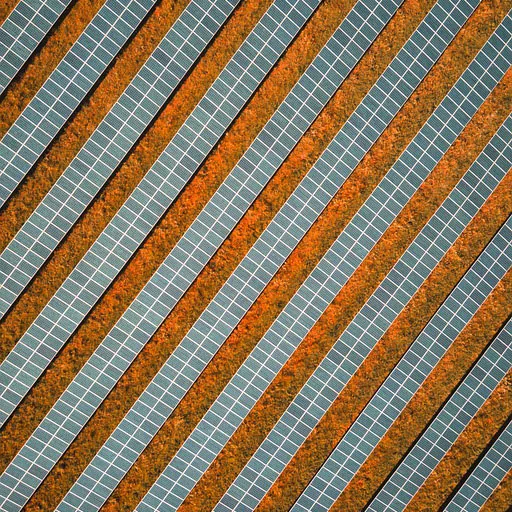

CohnReznick Capital is pleased to announce that sPower, which merged with AES’ clean energy business early this year, has secured tax equity financing for the 155MW North Peak portfolio. The portfolio consists of four projects located in Utah and California, including the 107MW Clover Creek project and ANTEX 1B, 3A, and 3B, totaling 48MW. All four projects are under long-term 20-year busbar Power Purchase Agreements with investment-grade municipalities.

CohnReznick Capital was the exclusive financial advisor on the transaction.

“We are excited for our continued support and success with a market leader like AES,” said Conor McKenna, Senior Managing Director at CohnReznick Capital. “Efficient execution in the face of exogenous headwinds shows that this market will continue to thrive on the backs of great projects and strong partners.”

For additional details on this transaction, please contact:

Conor McKenna

Senior Managing Director

conor.mckenna@cohnreznickapital.com

Andy Nguyen, Vice President

andy.nguyen@crc-ib.com

About AES

The AES Corporation (NYSE: AES) is a Fortune 500 global energy company accelerating the future of energy. Together with our many stakeholders, we’re improving lives by delivering the greener, smarter energy solutions the world needs. Our diverse workforce is committed to continuous innovation and operational excellence, while partnering with our customers on their strategic energy transitions and continuing to meet their energy needs today. For more information, visit www.aes.com/even-better-together/.