Tax Credit Transfer Market Spotlight Q1 2025

Market Overview

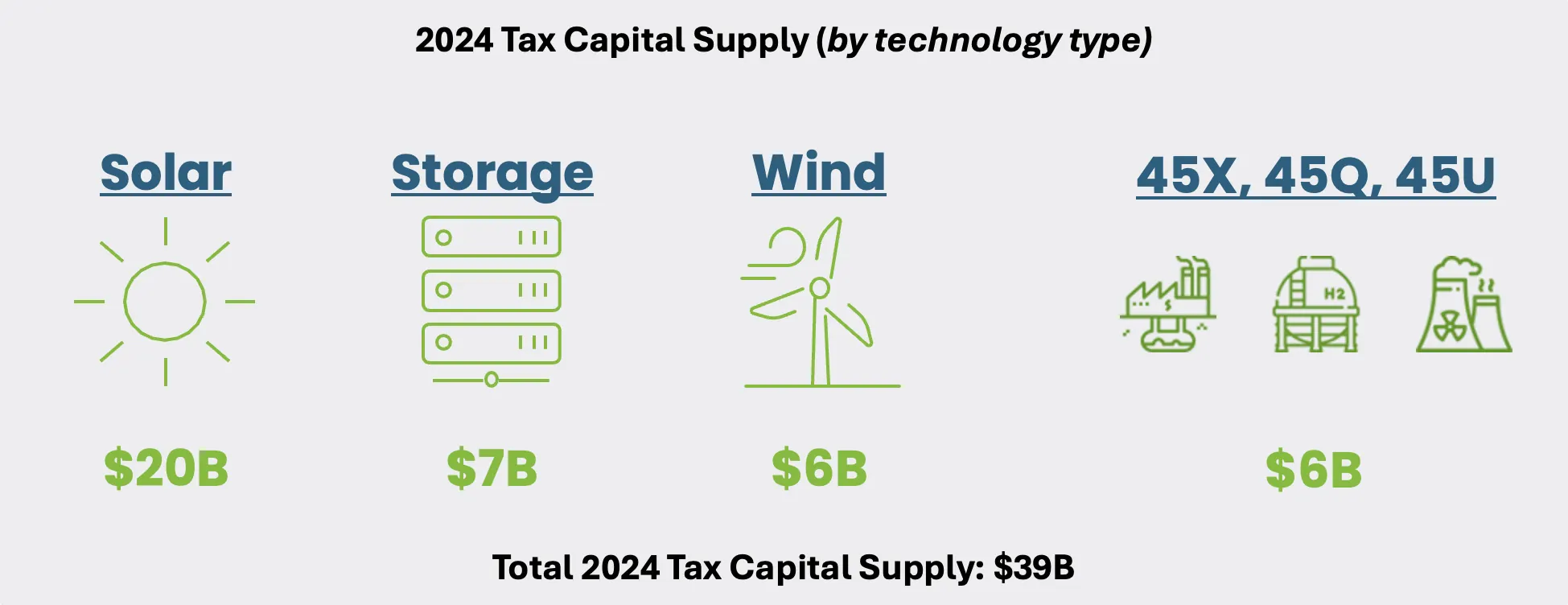

The clean energy tax credit transfer market continues to expand, offering significant opportunities for investors to reduce tax liabilities while advancing clean energy projects. In 2024, over $33 billion of tax capital was deployed for solar, wind, and battery storage — a 30% increase from the previous year. An additional $6Bn was deployed in 2024 for 45X, 45Q, and 45U tax credits.1

Price Variability in the Market

Tax credit transfers allow renewable energy developers to monetize Investment Tax Credits (ITC) and Production Tax Credits (PTC) by selling them to third-party buyers. Credits are typically purchased at a discount, ranging between $0.90-$0.95 per $1.00 of ITC and as high as $0.98 per $1.00 of PTC.

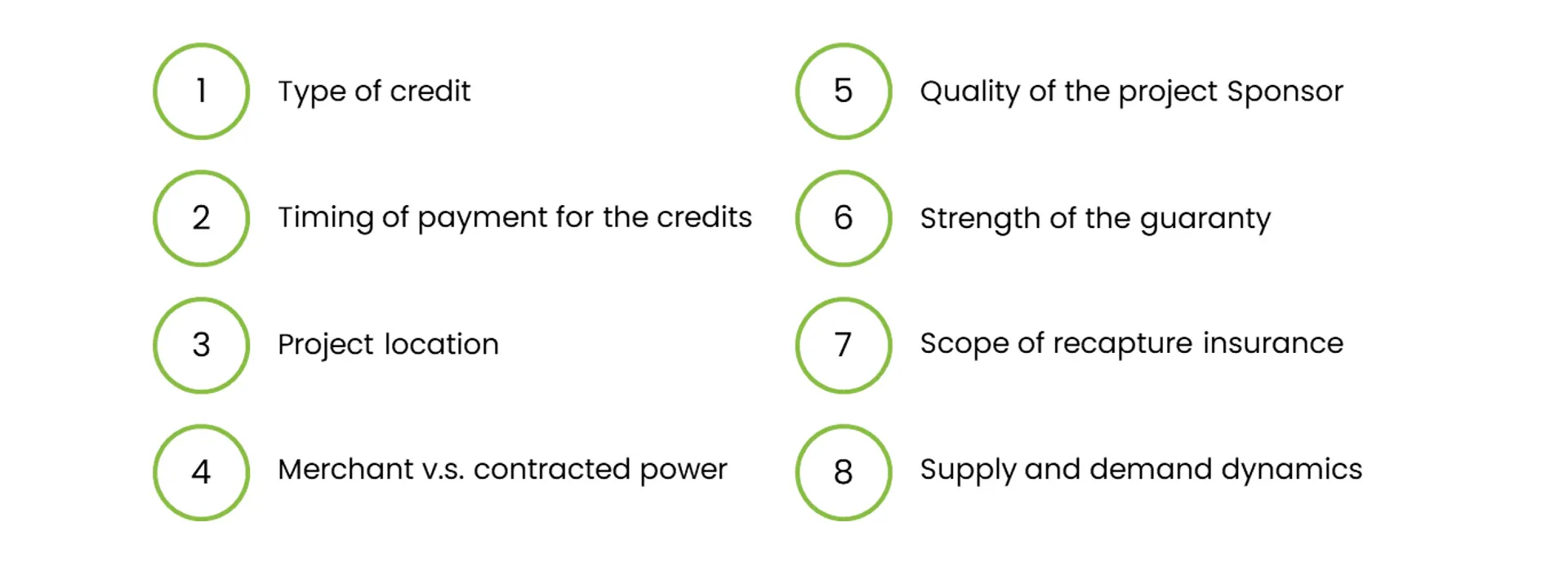

CRC-IB currently views the following 8 factors as the biggest contributors to credit pricing volatility:

Mitigating Risk of Tax Credit Recapture

Tax credit recapture can occur if credits are disallowed by the IRS, often due to changes in ownership, project damage, or structural issues. Buyers can mitigate risks through:

- ITC Insurance: This covers recapture risks associated with the validity of the Seller’s status, ensuring the transfer is legally recognized, the Fair Market Value and ITC amounts are upheld, credit adders are respected, and ownership changes are protected, among other factors.

- Sponsor Guarantees: Typically, the project Sponsor will provide a guarantee to backstop the ITC insurance for any recapture not covered by the policy, provided the recapture is not caused by the actions of the Buyer.

- Third-Party Reports: These reports ensure accurate credit valuation and compliance throughout the transaction process.

Impact of Trump’s Recent Executive Orders

In the first days of the Trump Administration, the President acted to temporarily halt federal agencies from approving or renewing permits, leases, and loans for onshore and offshore wind projects while the Department of Interior conducts reviews of wind leasing and permitting practices. While most onshore wind projects are on private land and rely on state and local permits, some federal approvals may still be required for:

- Crossing federal land (e.g., for roads or transmission lines).

- Protecting endangered species or wetlands.

- Ensuring no hazards to aviation (FAA reviews).

- Projects involving foreign investors or large-scale impacts.

A common question is whether the freeze on funding disbursements affects tax credits under the Inflation Reduction Act (IRA). The answer is no. Tax credits are established by law and cannot be revoked or withheld via an executive order. Any changes to these credits would necessitate Congressional action.

CRC-IB Highlights

To date, CRC-IB closed on the sale of over $2.7 billion of tax credits. In 2024 alone, CRC-IB advised on the sale of $1.6 billion of tax credits across 15 transactions. Additionally, for the sixth consecutive year, CRC-IB was named the #1 North America Financial Advisor by deal count in Infralogic’s 2024 league tables.

Featured Transaction: Arevon Energy – $350MM Condor Energy Storage Project Financing

|

Select CRC-IB Tax Credit Transfer Transactions

Solar and Solar + Storage |

|

Standalone Storage |

|

Emerging Industries |

|

For more information or to discuss how tax credit transfers can benefit your organization, please contact Nicolas Chery, Managing Director.

References