Quarterly Considerations Q1 2025

CRC-IB is closely monitoring the evolving tariff environment following recent announcements from the Trump Administration. While the full impact remains to be seen, the prospect of near-term tariffs could contribute to higher costs, project delays, and dampened transaction appetite across the clean energy transition. Additional or reciprocal tariffs could further complicate global manufacturing already impacted by the antidumping and countervailing duty (AD/CVD) petitions. Final determinations in these cases are expected later this spring, and countries where production has shifted as a result of the AD/CVD cases could soon face their own challenges. Rather than speculate, CRC-IB is focused on tracking developments in real-time and advising clients based on actionable information. We will continue to provide updates as the situation evolves.

M&A Trends

Private capital is driving the energy transition, but IPOs aren’t too far out

Private capital has solidified its position as a key funding source for independent power producers (IPPs), offering stability amid market fluctuations. Between 2012 and 2022, private capital — across all industries and asset classes, including private equity, venture capital, private debt, real estate, and more — grew at 2.5 times the rate of public equity and fixed-income market assets, driving global private capital AUM to $14.7 trillion.1 This reflects a broader shift, as companies increasingly remain private longer to avoid the short-term pressures of public markets. For renewable IPPs, private capital is particularly attractive due to the long development timelines, policy-driven complexities, and the need for patient, tailored investment strategies.

While sustainable energy IPO activity has been limited, CRC-IB expects more energy platforms to go public — as the industry matures and IPPs achieve greater scale and revenues — to access larger pools of capital and improve liquidity. Macroeconomic stability and increased investor comfortability with renewables will further help this story. Despite the expected growing role of IPOs, private capital will continue to play a crucial role in platform growth and energy asset acquisitions, offering flexibility and stability for developers navigating evolving market conditions.

Opportunity exists amid valuation recalibrations

Since the peak of 2021-2022, valuation multiples have compressed, leading to a more fundamentals-driven approach where buyers prioritize high-confidence projects over speculative pipeline acquisitions, causing operating and late-stage assets to receive the most value.

As an illustration, a platform with a late-stage pipeline, significant operating cash flow, and a proven track record may receive a valuation multiple of >9x EBITDA. In contrast, a platform with an earlier-stage pipeline, a limited track record, and reliance on emerging markets for growth could receive a <5x EBITDA multiple.

Valuations are expected to rebound in the next 12-24 months, but several larger platforms are coming to the market, and larger deals are still getting done. As buyers and sellers continue to recalibrate expectations, a unique opportunity exists for buyers who are willing to take a long-term view while riding out short-term volatility to acquire a platform before valuations rebound.

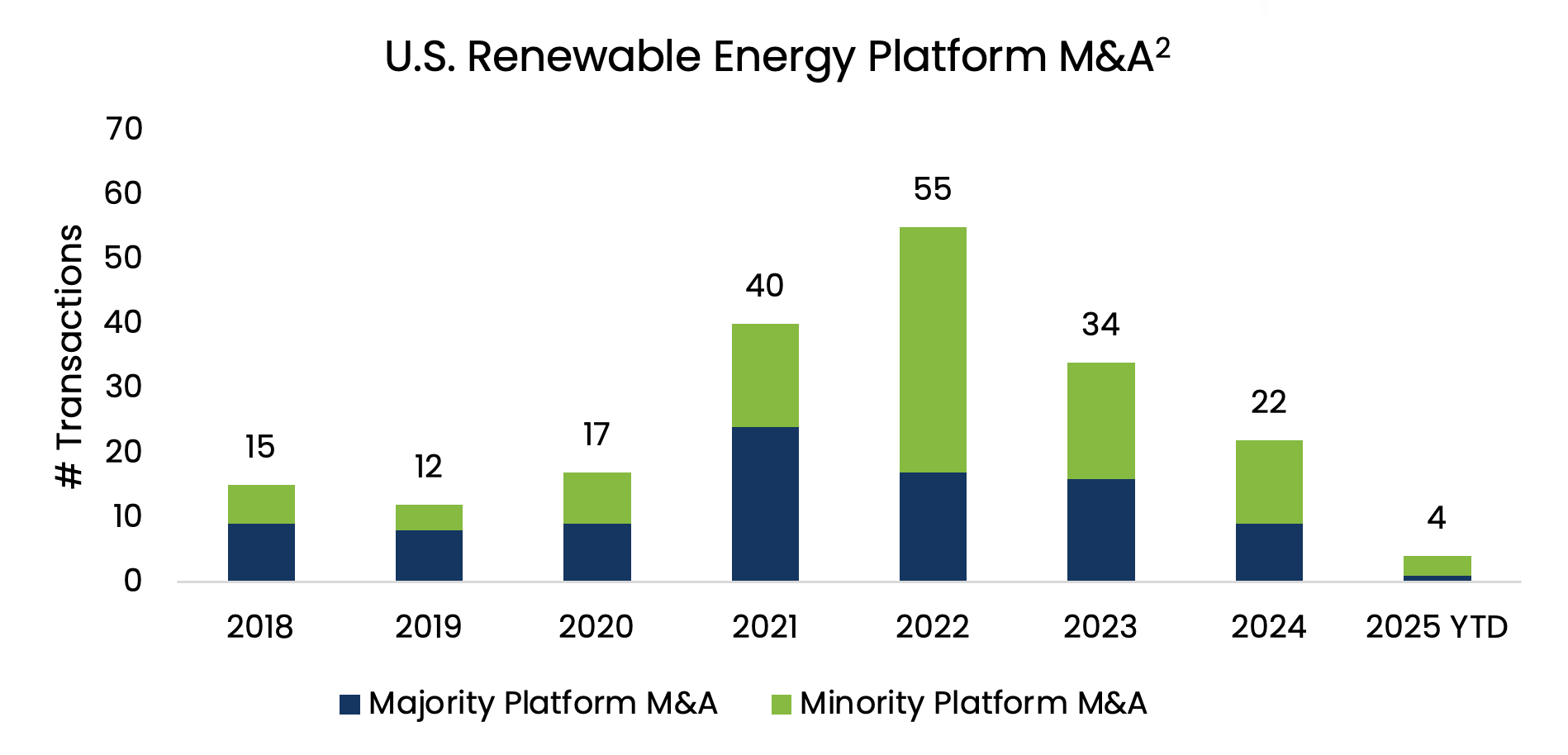

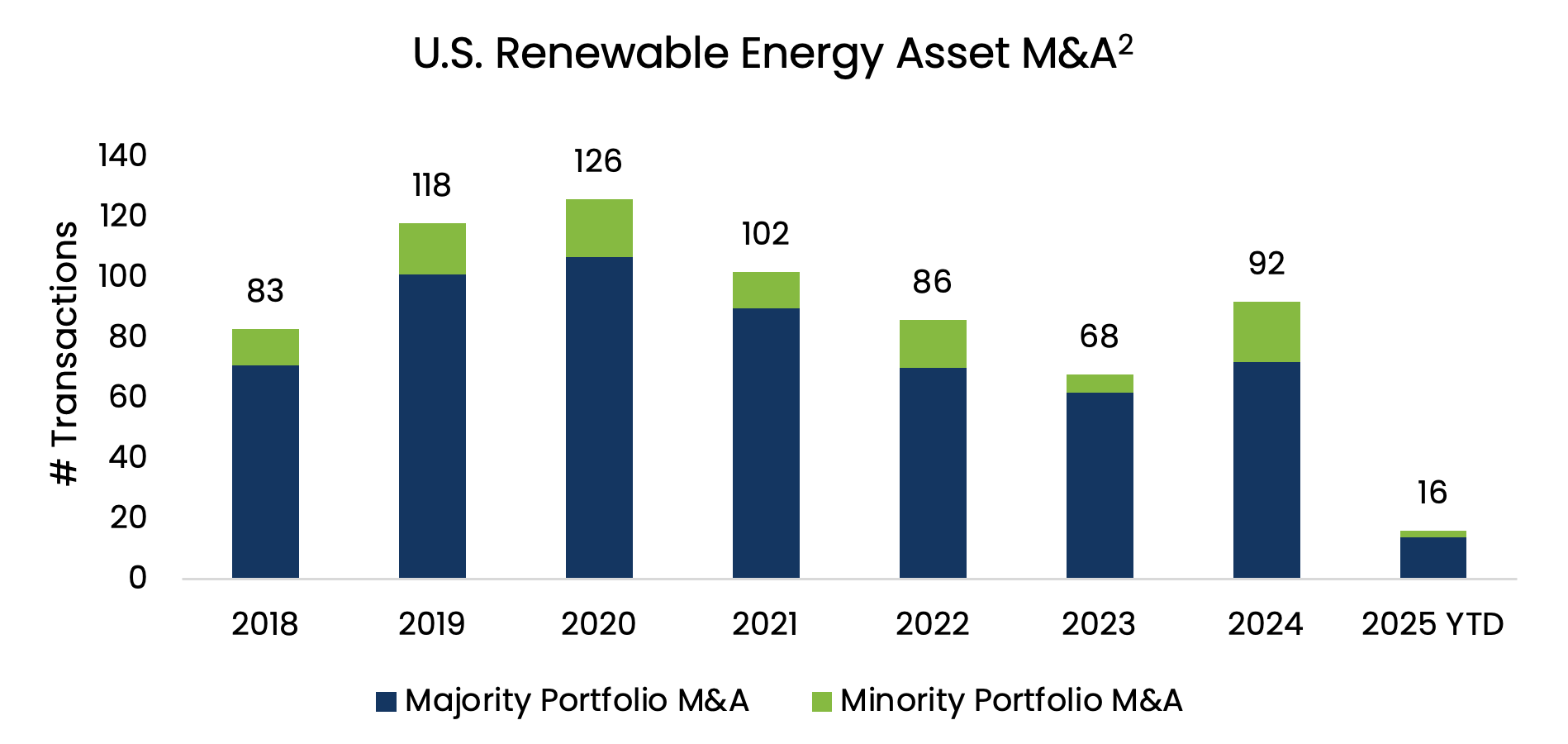

Structured financing solutions, such as preferred equity and corporate debt structures, play an increasing role in bridging valuation gaps. Many developers are struggling to secure credit because their assets are not advanced enough to unlock sufficient capital. As a result, preferred equity has emerged as a key solution, allowing developers to receive value for early-stage assets and continue advancing their pipelines. At the same time, asset sales remain a viable strategy, with developers monetizing part of their portfolio as they adapt to market conditions. The market saw a ~35% YoY increase in renewable energy asset sales in 2024, partially driven by developers shifting toward more frequent asset sales in response to financial constraints and changing market dynamics.

Long-term resilience and industry consolidation

Despite near-term market fluctuations, the long-term outlook for clean energy remains strong, driven by factors including the increasing energy demand of AI data centers, growing ESG commitments, and potential clarity on federal renewable policies. The sector has historically demonstrated resilience across political cycles, with state-level policies and corporate demand playing a more significant role than short-term federal shifts. CRC-IB expects this to remain true.

At the same time, consolidation in the sustainable energy sector is becoming increasingly inevitable, particularly for smaller developers facing financial constraints, such as interconnection and PPA deposits or near-term capital calls. We expect some consolidation to occur through strategic partnerships like joint development service agreements rather than majority or 100% corporate acquisitions. IPPs will likely become larger as the industry matures, reinforcing the trend toward scale and efficiency. M&A activity and strategic consolidation will play a growing role in shaping the future of the clean energy industry.

Project Finance Trends

Pricing remains stable as structure variability becomes key

- Tax Equity Yield-Based Flips: 8.0-10.0%

- Tax Equity Calendar-Dated Flips: 1.18x-1.35x MOIC

- Transfer Pricing: $0.87-$0.95 (gross)

- Term Debt: SOFR + 150-250bps

The cost of tax and debt capital has remained fairly steady over the past 12 months. What has evolved are the structuring mechanisms behind the reported pricing range. Hybrid tax equity yield-based flips are gaining popularity — allowing investors to participate in more deals by monetizing deprecation while transferring all or part of the tax credits to a third-party buyer. A key factor in this structure is the discount applied to the tax credit value. If the tax equity investor assumes $0.90/credit under the hybrid structure, their upfront investment is lower vs. a traditional structure where they retain all credits, assuming the IRR remains constant. This nuance wouldn’t be captured by reviewing flip yields alone.

Another evolution is transfer pricing. While the overall price range hasn’t changed significantly, there is now greater clarity on factors influencing purchase price. Elements such as credit type, payment timing, project location and revenue streams, sponsor track record, and guaranty strength play a critical role in determining credit pricing within the reported range.

Annual tax capital supply was the highest ever in 2024

In 2024, tax capital supply recorded an all-time annual high, increasing ~32% YoY, with the industry experiencing record transaction volume. There was at least $33Bn deployed for solar, wind, and battery storage and an additional $6Bn for emerging industries (45X, 45Q, and 45U tax credits).3 CRC-IB attributes this growth to new IRA-driven structures — enhanced comfort from over a year of precedent transactions, transferability attracting new entrants, and hybrid structures expanding supply — as well as the rise of alternative technologies and growing comfort with a broader range of energy tax credits.

Protection from changes in federal policy

Despite concerns over potential policy shifts, CRC-IB does not anticipate direct changes to the Investment Tax Credit (ITC) or Production Tax Credit (PTC). Although President Trump signed executive orders on renewable projects and associated federal programs just days into his administration and has been vocally anti-renewables, the Inflation Reduction Act remains the law of the land, and any material changes to its provisions would require congressional action. Market participants are understandably wary over potential changes and are mitigating risk under tax capital commitments in documentation.

Increasingly, investors seek indemnities from sponsors for tax law changes, allowing them to adjust their commitments if policies shift before or even after funding. These downside protections help offset adverse impacts facing investors and help unlock tax capital in a somewhat uncertain policy environment. With bipartisan support for the IRA, competitive renewable power economics, and private sector net-zero commitments, the case for sustainable energy U.S. investment remains strong.

Flexible structured debt facilities are an increasingly popular option to satisfy financing needs

More developers are seeking structured debt facilities, including warehouse, equipment / development revolvers, etc., to fund ongoing operations, development, and construction costs, secured by both their asset collateral and balance sheet. Depending on the portfolio, these facilities can include both pre- and post-NTP assets, allowing for the flexible use of upfront proceeds. As M&A activity gradually picks up, CRC-IB anticipates increased interest in these facilities to improve efficiencies, optimize the cost of capital, and enhance the top-co equity value. By leveraging development pipelines and operating cash flow collateral, developers can reduce their equity requirements, particularly as they come close to exhausting their existing equity commitments and equity return thresholds remain higher. Utilizing this additional borrowing base with the ability to recycle capital and minimize the need for repeated transactions, these structured debt facilities at scale are an increasingly attractive financing solution.

CRC-IB’s Recently Completed Transactions

| Counterparty | Sponsor | CRC-IB Role | Date | Transaction Synopsis |

| Confidential | Confidential | Exclusive Financial Advisor | 3/2025 | Debt Financing for 403MWDC Solar + 172MW Storage Project |

| Confidential | Confidential | Exclusive Financial Advisor | 3/2025 | Tax Equity Financing for 38MWDC DG Solar Portfolio |

| BNP Paribas, CIBC, Credit Agricole, KeyBanc, Natixis, Wells Fargo | Copia Power | Exclusive Financial Advisor | 3/2025 | Debt Financing for 550MW Solar + 2,200MWh Storage Project |

| Confidential | Confidential | Exclusive Financial Advisor | 2/2025 | ITC Transfer for 200MWDC Solar + 60MW Storage Project |

| Confidential | Confidential | Exclusive Financial Advisor | 2/2025 | ITC Transfer for 145MWDC DG Solar Portfolio |

| Confidential | Arevon | Exclusive Financial Advisor | 2/2025 | Pref Equity Investment for 200MW / 400MWh Battery Storage Project |

| Confidential | Dimension Energy | Exclusive Financial Advisor | 1/2025 | ITC Transfer for 122MWDC DG & Community Solar Portfolio |

| Confidential | Confidential | Exclusive Financial Advisor | 1/2025 | ITC Transfer for Hydrogen Storage Equipment at 15tpd Liquefaction Facility |

| Confidential | Confidential | Exclusive Financial Advisor | 1/2025 | Tax Equity Financing for RNG Portfolio with 767,000 MMbtu / yr of Production |

| Confidential | Eolus | Sell-Side Advisor | 1/2025 | Sale of 100MW / 400MWh Battery Storage Project |

References

- Pitchbook: Private Capital’s Path to $20 Trillion, May 1, 2024

- Announcements tracked from inframationnews.com and available press releases through March 2025

- Norton Rose Fulbright