Quarterly Considerations Q3 2024

M&A Trends

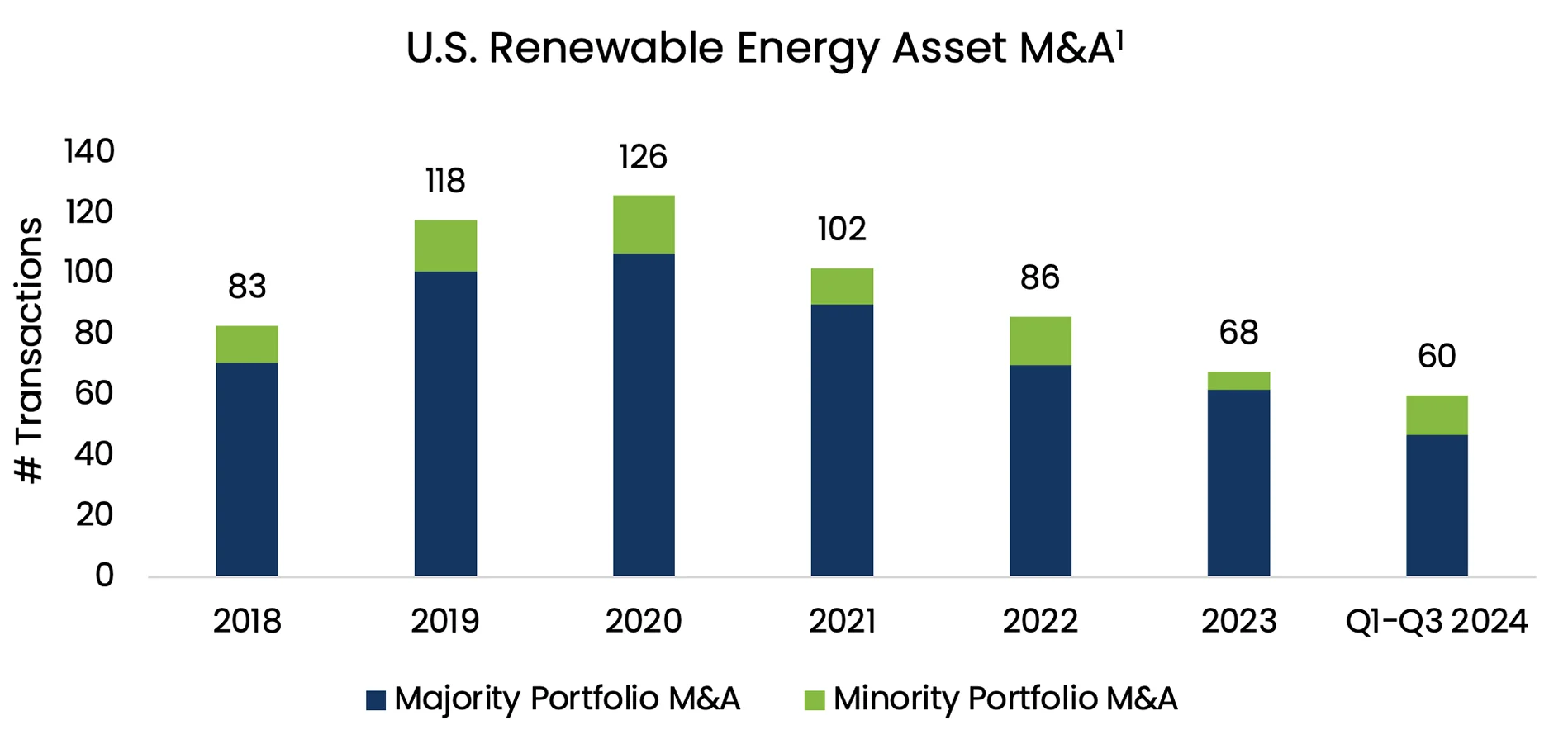

The 2024 asset M&A market is robust, with an uptick in demand for post-development assets.

CRC-IB continues to observe signs of increased M&A activity across solar, storage, and wind assets. In Q3 2024 alone, there were 18 completed transactions totaling 9.6GW of generation – a 3x capacity increase over Q3 2023.1 Many clean energy projects previously scheduled to begin construction this year or next have faced delays due to supply chain issues, rising project costs, and high cost of capital. As a result, there is a shortage of projects that can be completed in the next two to three years, despite strong demand for renewables. This situation has intensified competition for available assets. Notably, around 55% of the M&A transactions completed in Q3 involved post-development stage assets, indicating a preference for under-construction and operational projects rather than those still in the planning or early stages.1

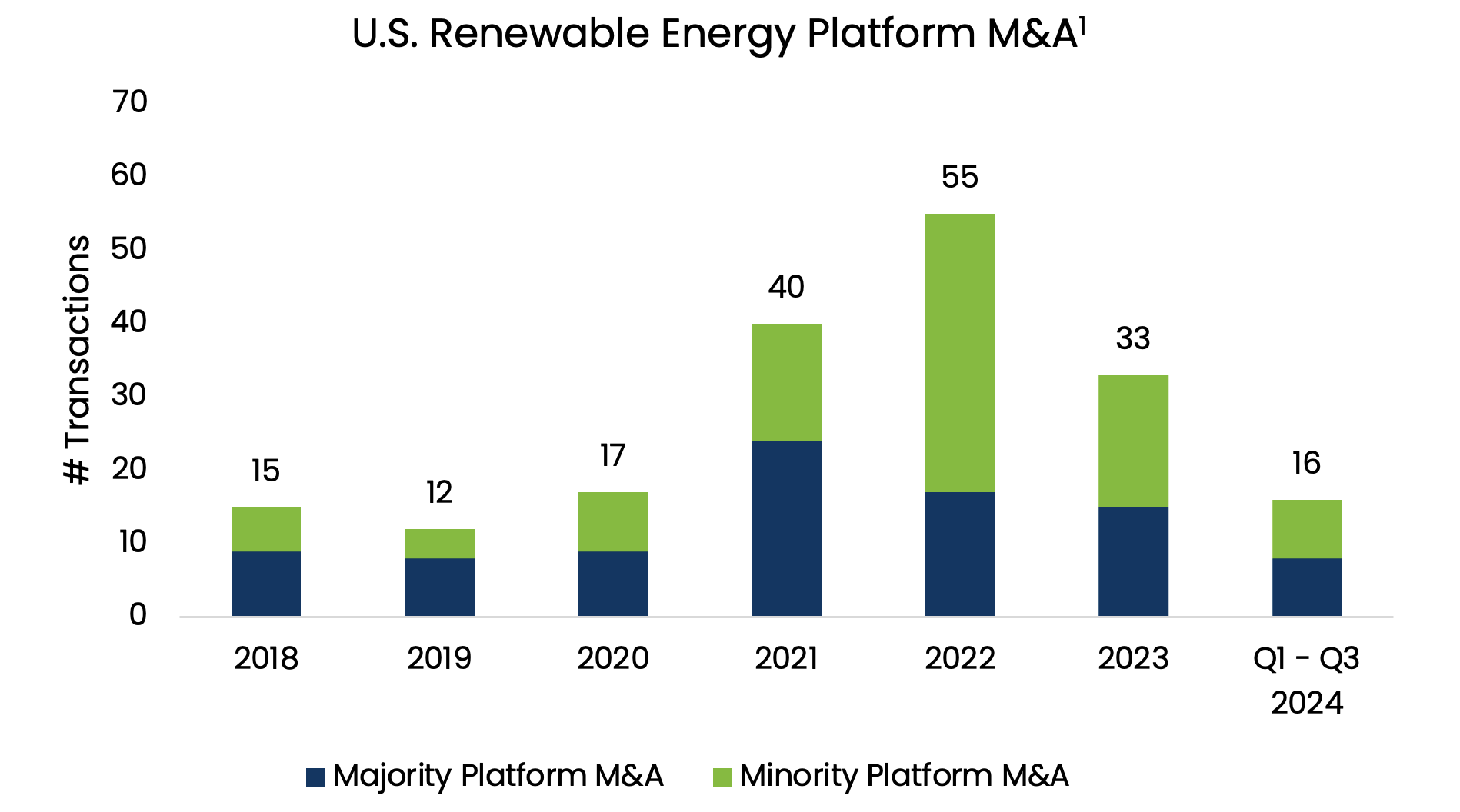

A potential resurgence of platform M&A in 2025.

CRC-IB anticipates that 2025 will be a strong year for platform M&A. After a decade of relatively low capital costs, developers are acclimating to the high-interest rate environment that has significantly impacted project-level economics, pipeline growth, and the ability to secure corporate financing. Recent market conversations with industry participants suggest the tide is turning. The Federal Reserve’s decision to cut interest rates by a half percentage point in September marked a significant shift. This was the first rate cut since 2020, signaling that monetary policy may be easing after an extended period of tightening.2 With another potential rate cut following the November Fed meeting, renewables companies are starting to see more favorable financing conditions on the horizon, which is likely to unlock more M&A investments.

Political uncertainty around the 2024 U.S. presidential election has been another factor keeping some market participants on the sideline. Concerns over the future of the Inflation Reduction Act (IRA) and federal clean energy policy have led many to adopt a wait-and-see approach. While some worry that a political party shift in the White House could lead to modifications of the IRA, a full repeal is considered unlikely.

Is it the end of the “land-grab” era?

The “land grab” era in renewable energy development may be coming to an end. In the past, developers sought to acquire as many projects as possible, taking advantage of the relatively low costs of development. Given the historically low odds of success in interconnection queues – where approximately 20% of projects progress to construction – developers adopted a strategy of building a pipeline with numerous projects.3 However, this approach is shifting as the increased cost of borrowing can make it harder for developers to build projects with sufficient returns.

Developers also have a better understanding of how development assets can maximize their platform’s value. Early-stage projects continue to drive deltas in valuation, and investors typically reward those developers with a proven track record of execution. Britta von Oesen, CRC-IB Partner & Managing Director, shared: “The groups that have the highest valuations are putting the value on the early-stage pipeline and the growth opportunities. If the track record is there and the team has shown capabilities to deliver these MWs, there’s no reason to assume that falls off a cliff after a couple of years.”

As the financial landscape evolves, developers will likely shift towards a “quality over quantity” mindset, while maintaining awareness of the value that development projects can bring to their platform. Developers are facing rising interconnection deposits and other costs, which make maintaining a large pipeline of pre-construction projects much more expensive. Prioritizing projects that have a realistic chance of moving through the interconnection queue will be key, especially for smaller developers, while aggressive portfolio accumulation may continue to be the path for developers with a strong reputation, track record, and deep pockets.

Project Finance Trends

Tax capital and debt pricing are relatively steady throughout 2024.

- Tax Equity Yield-Based Flips: 8.0-10.0%

- Tax Equity Calendar-Dated Flips: 1.14x-1.25x MOIC

- Transfer Pricing: $0.90-$0.95 (gross)

- Term Debt: SOFR + 175-200bps4

Over the last three quarters, CRC-IB has minimally adjusted pricing ranges for tax equity, transferability, and term debt. The optionality from transfer and hybrid structures has driven competition amongst tax investors and increased the investor pool for developers, creating a floor price mechanism and stabilizing the cost of tax capital. For debt, recent reductions in SOFR may not immediately impact the spread, but the lower total cost of debt should increase the total leverage used in project finance transactions and drive greater competition between lenders.

Tax credit transfer bridge loans are increasingly popular.

The increasing popularity of tax credit transfer bridge loans (TCTBL) reflects the robust tax credit transfer market and the growing willingness of banks to lend against tax credit sale proceeds. TCTBLs, like tax equity bridge loans (TEBLs), help sponsors secure construction financing against future proceeds. TEBLs are repaid with tax equity investor commitments once the project completes construction and is placed in service, and TCTBLs likewise bridge the gap between the capital needed for construction and the time at which tax credit purchasers are ready to pay.

Similar to TEBL lenders, TCTBL lenders must assess the creditworthiness of the tax credit buyer(s). To safeguard their investments, lenders may require financial covenants such as minimum liquidity or ratings requirements and/or credit support from a parent company. The demand for construction financing is, in some cases, outpacing the ability for developers to source tax credit buyers on attractive terms. Thus, projects may not have arranged tax credit sale agreements at financial close of the bridge loan. Under this scenario, some lenders are requiring full or partial credit support from the developer, which is more feasible for established developers with strong balance sheets but more challenging for the rest of the market.

The rise of tax credit insurance.

The use of tax credit insurance surged in 2024, with Lockton reporting a 34% increase in tax insurance policies bound in the first half of the year compared to all of 2023. A significant majority, around 90%, of these policies have been for Investment Tax Credit (ITC) deals.5 Much of the IRS audit focus is on the tax basis or structure of the deal itself. Insurers often cap the insurable basis step-up at 35%, and coverage typically includes protection against recapture if the IRS challenges the tax basis or the deal’s structure. The two risks work together as IRS scrutiny could lead to recapture if the step-up is deemed to arise from an invalid structure. Some investors may seek additional guarantees from the sponsor or sponsor’s parent company in addition to the ITC insurance to enhance their protection or if insurance does not fully cover the risk or the recapture amount. Additionally, legal opinions – whether they are “will” or “should” – may also play a role in reducing reliance on insurance, depending on their strength in supporting the deal’s structure.

Key Topic – CCUS Tax Capital Financing

Tax capital for carbon capture, utilization, and sequestration (CCUS) projects is in demand, and increasingly, CRC-IB is seeing strong interest from tax investors, especially banks and corporates, to provide supply. Tax capital provides an efficient, optimal structure for CCUS project developers, offering a commitment on the full 12-year profile of the 45Q credits, material upfront capital, and the ability to lever via bank financing on the contributions that monetize the 45Q.

Tax investors want good line of sight into CCUS projects going into construction and eventually operations when the tax credits are generated. IRS guidance requires only 20% of upfront contributions, which minimizes the upfront development risk for the investor and makes their investment more performance based. For developers, this presents a challenge as securing tax capital is the first piece of the capital stack. It may prove difficult for major tax investors to arrive at the commitment early in the CCUS project’s development lifecycle while they still have a binary risk on the horizon. This challenge leaves CCUS projects heavily funded by equity late into their development.

CRC-IB recently advised Harvestone Low Carbon Partners on a first-of-its-kind tax equity financing for its Blue Flint carbon capture and sequestration project in North Dakota. The structure enables the tax equity investor to participate in the 45Q tax credits and, when available, to purchase 45Z clean fuel tax credits generated by the biorefinery facility. CRC-IB continues to engage with CCUS developers as the industry matures and the need for tax capital financing grows.

CRC-IB’s Recently Completed Transactions

References

- Announcements tracked from inframationnews.com and available press releases through September 2024

- The Federal Reserve

- Lawrence Berkely National Laboratory

- Internally collected data from CRC-IB and conversations with market participants in Q3 2024

- Norton Rose Fulbright